“It’s Good To Talk”

Ian Green warns don’t leave tricky family money conversations hanging in the air this new year

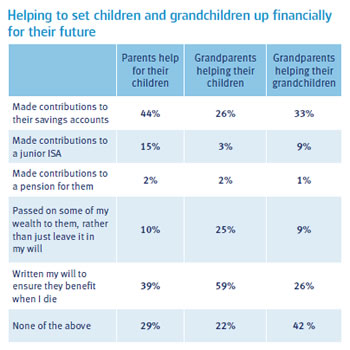

Putney Financial Adviser, Ian Green of Green Financial, considers ‘The Family Financial Tree report’* from Standard Life and how it looked at the family money tree over four generations. He found it made some surprising findings including revealing how families collectively manage and talk about their personal finances.

The findings, based on survey data of over 4,000 adults in Great Britain, drew compelling conclusions about what is effectively one of the last taboo subjects for families – the uncomfortable discussions around money, inheritance and retirement.

HOW MONEY FLOWED ACROSS FOUR GENERATIONS

The research tracked how money flowed across four generations of a family and also established how this flow of cash is reliant on families having some tricky conversations. The report also finds that many of us remain typically British and private about our finances. While we might involve our spouse or partner in discussions and future planning, few people say they communicate freely with others in their family about their finances.

FAMILY FINANCIAL PLANS INVOLVE ALL THE GENERATIONS

More than a third of parents (35%) and two fifths (43%) of grandparents would not ask anyone within their family for advice about finances. And despite evidence that a large volume of money is moving freely between generations, only one in four (25%) people say that their family financial plans involve all the generations. However, the attitude of new parents is very different. Almost four in five parents (79%) with children under the age of five would ask the family for money (79%) and three quarters (75%) would ask the family for financial advice.

THREE DISTINCT TYPES OF FAMILIES

The research has identified three distinct types of families: ‘talkers’ and ‘gifters’, who are likely to benefit from discussing the family money tree, and ‘avoiders’, who are failing to release the power of the family financial tree.

WHICH TYPE OF FAMILY ARE YOU?

‘Talker families’ are the 25% of the population who involve all of the generations when

planning family finances – they are likely to be open with each other, discussing salaries,

upcoming bills and even inheritance.

‘Gifter families’ are families who gift money between the generations to help with both

big and small purchases, whether it be a mum paying for Gran’s supermarket shopping or a

granddad contributing to his granddaughter’s education. ‘Gifters’ are also likely to be ‘talkers’.

‘Avoider families’, however, are the least likely to benefit from the family financial tree,

as they avoid money chat in their household, particularly the more difficult conversations.

This means they could be missing out on the combined strength of planning for the future

together and could be making decisions based on little information about future commitments or needs.

TIME TO START APPROACHING THESE TRICKY CONVERSATIONS?

Green Financial can help you approach these tricky conversations with your family and seek to understand future family goals and future commitments. If you are interested, please contact me without obligation for more information and to review your particular situation.

iangreen@iangreen.com

You can see what others have said about Green Financial here: www.vouchedfor.co.uk/financial-advisor-ifa/putney/709-ian-green

*Source:

The research is based on survey data. 4,071 UK adults were surveyed by YouGov on behalf

of Standard Life between 4 and 7 October 2013, weighted to nationally representative criteria. Of the base sample, 1,633 (unweighted) parents,who were not also grandparents, were asked a series of specific questions based on their status.

In addition, of the base sample, 885 (unweighted) grandparents were asked a series of specific questions based on their status. The survey was conducted online.

Full report: http://www.standardlife.com/static/docs/2013/the-family-financial-tree.pdf

| The required small print: Please don’t take this article as personal or specific financial advice. It is intended to be guidance only. The value of any tax break will depend on your personal circumstances. Tax and the associated laws are subject to almost constant change. This is correct as at the time of writing. E&OE. If you are in any doubt as to whether this information is of benefit to you please seek independent financial advice. Please remember if you invest in stocks and shares the value of your investment can go up as well as down. Other elements such as currency exchange fluctuations could affect the value of your investment. If you have property based investments you may not be able to sell when you wish to realise your funds. Past performance is no guarantee of future returns. If you invest in cash based investments inflation may erode the purchasing power of your savings. Green Financial Advice Limited is Authorised and Regulated by The Financial Services Authority No. 523308 |

January 8, 2014